Last month, GodsOfOdds published my article discussing the superior efficiency or accuracy of Pinnacle’s closing odds over the closing odds of other bookmakers. Pinnacle operate a “winners welcome”, high turnover, low margin bookmaking model. The only way they can achieve this is to be more efficient at pricing sporting events than everyone else.

Since their closing odds provide an excellent representation of the true odds, we can use this hypothesis to predict the expected value (EV) of a bet with another bookmaker whose odds are longer. For example, if Pinnacle’s odds are 1.95, and 2.00 with their margin removed, another bookmaker with odds of 2.10 would be offering the bettor an EV of 5% This is simply calculated by dividing 2.10 by 2.00 (and subtracting 1).

Repeating this calculation for a sample of bets allows you to estimate the EV for that sample. You simply need to calculate the average EV. For example, if you had 5 bets with EVs 1%, 2%, 3%, 4% and 5%, your sample EV would be 3%. If you had used the same flat stake size for each bet, then simply multiply by the number of bets to calculate your expected profit. In this case, if each bet were $100, your expected profit would be $15. If using different stakes for each bet, you’d need to multiply each EV by each stake individually before summing.

Finding expected value in this way has formed the basis of my own betting system: Wisdom of the Crowd. Arguably, it should really be called the wisdom of the Pinnacle crowd, or even the wisdom of Pinnacle’s traders and sharpest customers since they provide the greatest influence towards shaping the efficient prices. Nevertheless, dumb betting crowds also play their part, particularly via their much greater weight of money and where their errors are random, so I continue to use the phrase.

I have made available a betting system PDF describing its full methodology, including how to remove Pinnacle’s margin. GodsOfOdds has already published one of my methods for doing this. My PDF describes a couple more. The system uses pre-closing prices since closing prices are effectively impossible to bet. You don’t know what the closing price is until after the market has closed, by which time it is too late to bet. Fortunately, whilst Pinnacle’s pre-closing prices are not as efficient as their closing ones, they still provide a reasonable estimate of true outcome probabilities, and are certainly more efficient than the equivalent prices of other bookmakers, so the model hypothesis should still hold true.

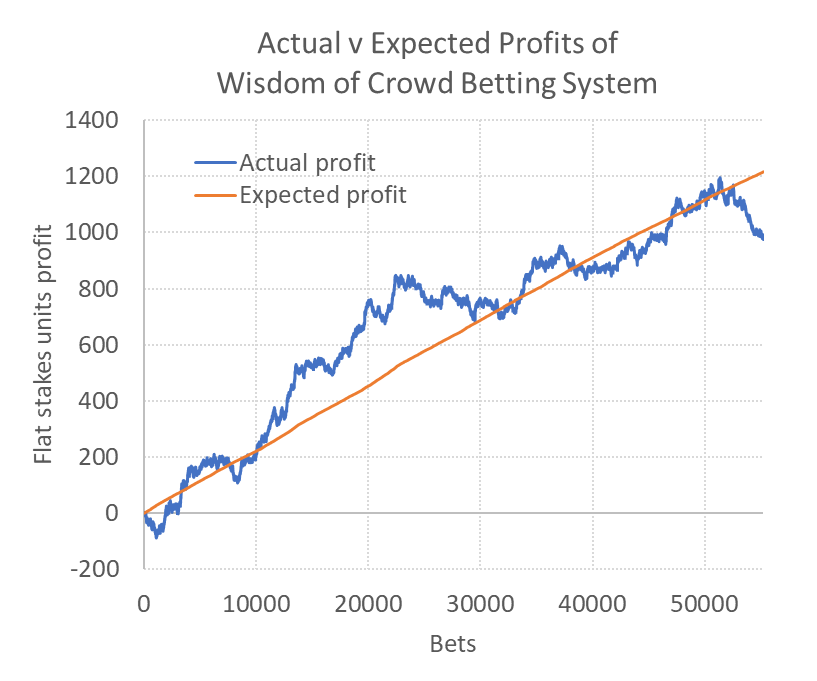

Let’s take a look at how the betting system has performed. I’ve issued system picks live since August 2015, but here I will review the hypothetical performance dating back to July 2012. Since that time and until the closure of European league football due to the Covid-19 pandemic in March, there were 55,237 occasions where the best market home-draw-away price, as advertised by the odds comparison Oddsportal, was greater than the true price as implied by Pinnacle’s odds.

The average EV, and hence expected yield, for this sample of bets was 2.20%. The actual yield based on the results would have been 1.77%. This underperformance could be due to my model inaccuracy, or it could be due to bad luck, or it could be due to a bit of both.

We can test how unlucky this underperformance would be, assuming the Pinnacle hypothesis model to be accurate, using my betting yield distribution calculator. With average betting odds of 3.30, 25% of performances would be worse by chance. I would only start to really worry there was something wrong with my Pinnacle hypothesis model if this figure were less than 1%.

The actual and expected profit growth is shown in the chart below.

There might be some readers who would say that a yield of 1.77% is nothing spectacular. They probably haven’t been betting for as long as I have and haven’t fully appreciated how hard it is to find any kind of expected value at all. Nevertheless, let’s see if we can do better.

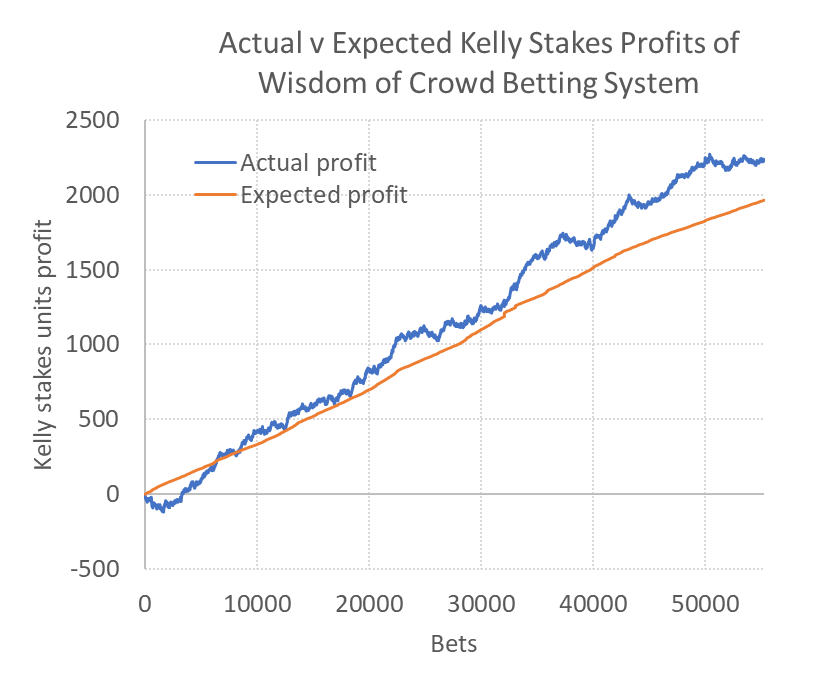

Since my model hypothesis explicitly calculates the EV for every bet, we could choose to stake more for bets with higher EV. That, in fact, is exactly what the Kelly money management plan advises. Designed specifically for progressive staking systems where stake size grows as a proportion of one’s current bankroll, I’m going to use it here only as a non-progressive version. Thus, stakes will remain relative to the initial bankroll, not the one that grows (or shrinks).

The Kelly criterion advises a stake size according to the following formula:

K = EV / odds -1

For example, if your EV was 5% (or 0.05) and your betting odds were 3.00, then the Kelly stake size would be 0.05 / 2.00 = 0.025 or 2.5%. Here, if I started with a bankroll of 100 units, this would imply a 2.5-unit stake.

For my 55,237 bets, the total Kelly stakes would have been 84,671 units. To ensure I am comparing the profitability from Kelly stakes to the performance from flat stakes before, I must standardise my Kelly stakes so that the total comes to 55,237 units. To do this, I divide each Kelly stake by the ratio 55,237/84,671. You wouldn’t necessarily need to bother with this if you were betting in real time, this is purely for comparative purposes.

The performance to Kelly staking is shown below. Now the expected yield is 3.56% whilst the actual yield was 4.03%; a sight over-performance but again not a sign that there is anything wrong with the model.

By using Kelly staking, we are placing more stake weight on bets with bigger EV, risk adjusting for the length of the odds. The fact that it does much better than flat staking is a further justification that the model is doing exactly what it is supposed to be doing. We are risking more money on bigger EV bets and are being rewarded for that.

The major downside to this betting system is that it only really works at bookmakers less efficient than Pinnacle. There is a reason they are less efficient: they choose to be so. Firstly, because they prefer to spend more of their revenue on advertising, marketing, bonuses and being best in market for some matches to attract new customers, and less than Pinnacle does on data analysis and setting odds. Secondly, because they can restrict or close the accounts of any customers then find to be abusing the generosity that makes this betting system possible.

Nevertheless, even small stakes of say an average of $10 would have returned a profit since July 2012 of over $20,000. Not enough to form a professional income, but certainly enough to have a decent annual vacation. And at these stakes there would be a much better chance of staying under the radar of bookmakers looking to restrict winning customers, especially If that were spread across a number of different bookmakers.

The Wisdom of the Crowd betting system is a proven winner. It’s been delivering profits for people who follow me in real time since I went live with it in August 2015. And it has a tested reliability going back many years more. Have fun using it.

0 comments

Please login to write comments

Login